The Coming Crypto Election

How Crypto Is Used for Political Corruption

The second episode in my podcast series starts with the testimony of Brandon LaRoque. He lives in North Carolina, ran a bar for 21 years and kept his life savings in a cryptocurrency account. One morning, as he went to check his balance, LaRoque discovered that it was all missing:

We didn’t know what we were gonna do. I contacted my local sheriff. They did not have a cybercrimes unit. I contacted my local police department. They don’t have a cybercrimes unit. I also contacted the FBI. With the FBI, it was like, Just fill out a report. And I think there’s, like, less than a 1 percent chance of getting any of our crypto back. I mean, I hope there’s more, but I just really doubt it.

LaRoque, who didn’t trust banks, was a victim of the unregulated crypto industry. Why is it unregulated? Because crypto-oligarchs don’t want it to be regulated, and because they now have an enormous amount of political power: the Trump family makes money from crypto companies too. On this same episode, I also talked to the analyst Molly White, the author of citation needed, an excellent, tech-skeptical newsletter. She told me that regulations are actually being removed:

when we saw crypto collapses throughout the past handful of years, there were many instances where people lost their funds and they said, I thought I had the same protections as a bank. I thought the FDIC would step in and reimburse me. And now we are actually seeing the regulators being pulled back and told to step away from the crypto industry. And we’re seeing legislation being passed that would essentially enable the crypto industry to expand its business activities without any additional consumer protections.

The crypto industry wants more than just deregulation. They want digital currencies to become part of America’s strategic reserve. They want crypto criminals pardoned. For that reason, Molly told me, they played a huge role in the 2024 election:

We saw the involvement of these massive, single-issue pro-cryptocurrency super PACs that were getting heavily involved in congressional elections. The industry contributed over $150 million to those super PACs. They spent around $130 million influencing congressional races, where they were hoping to either install pro-crypto candidates or remove people who were viewed to be enemies of the crypto industry. At one point it was almost half of all corporate spending was coming out of the cryptocurrency industry.

You can expect more of this in the midterms:

We’ve already seen these same crypto PACs from 2024 raising money for the 2026 elections. We’re actually seeing new super PACs being established. One of them has already committed to spending $100 million in the midterms. And we’re seeing politicians and candidates speaking very frankly about wanting to install pro-crypto candidates.

As I argued in episode one, don’t just look at the Trump administration’s tactics, look at the longer strategy. And keep asking: how will these authoritarian tactics be used to shape elections?

Listen to the whole podcast, or read the transcript, here.

Or listen and subscribe anywhere you prefer:

Apple Podcasts | Spotify | YouTube | Overcast | Pocket Casts

Kleptocracy Tracker

Continuing to monitor conflicts of interest, ostentatious emoluments, outright corruption and policy changes that will facilitate outright corruption. (Read my original article, Kleptocracy Inc and check out the SNF Agora Institute chart)

January 10

The Trump Organization announced plans for $10 billion in luxury developments to be built in Saudi Arabia in partnership with DarGlobal.

January 13

Pete Hegseth announced that the Pentagon would integrate Elon Musk’s xAI into its networks, following the awarding of a $200 million contract to the company last year.

January 14

The Trump administration sold $500 million worth of crude oil it had received from Venezuela as part of a deal reached with Caracas after the captured Nicolás Maduro. A large portion of the revenue is being held in a Qatari bank account controlled by the US government.

US oil refiners such as Valero Energy and Marathon Petroleum are positioned to soon profit from new access to Venezuelan crude oil.

The Trump administration also filed a warrant to seize additional tankers attempting to leave Venezuela, further increasing US control over the country’s oil exports.

Oilfield services firm SLB—whose standing in Washington declined after it chose to continue operations in Russia following the full-scale invasion of Ukraine—is positioning itself to benefit from Trump’s $100 billion investment plan for Venezuela’s oil sector.

January 15

Halliburton announced plans to swiftly re-enter Venezuela to help rebuild the country’s oil and gas infrastructure in response to Trump’s investment plan.

Donald Trump Jr. is both an investor in and an unpaid adviser to Polymarket, as well as a paid adviser to Kalshi—the two largest competing prediction markets, where users can bet on event outcomes, many of which are influenced by his father.

The Trump administration made its first sale of Venezuelan crude oil to Vitol Group, whose senior oil trader had donated $6 million to PACs backing Trump’s re-election campaign.

Who benefits from Venezuelan oil?

In the two week since the US military captured Nicolás Maduro and his wife, the Trump administration’ has offered a range of justifications for that action. But the president himself seems interested in only one: We need Venezuela’s oil.

But who exactly needs Venezuela’s oil? The United States faces no energy shortage; it is the world’s largest producer of crude oil and natural gas. Prices at the moment are relatively low. Last week, Trump convened a White House meeting with executives where some firms, particularly Exxon Mobil, expressed hesitation about committing tens of billions of dollars to a country with severely degraded oil infrastructure, no stable governance framework, and a history of expropriating foreign assets.

Yet if the US public doesn’t need the oil, it seems that the Trump administration does. Due to the US naval blockade, Venezuela has been unable to export between 30 and 50 million barrels of crude—roughly the maximum volume the Venezuelan state-owned company, PDVSA, can store before halting production. That oil has now been turned over to the US for sale on the global market. The administration has already lined up buyers for roughly $500 million worth of Venezuelan oil, including trading firms Trafigura and Vitol. (Again: a senior trader at Vitol also donated $6 million to Trump’s reelection campaign).

And here’s the most novel aspect: portion of the proceeds from these sales are being held in a Qatari bank account, with the rest distributed across additional government-controlled accounts. US officials expect total sales to reach at least $2 billion, while simultaneously asserting indefinite control over Venezuela’s oil sector—raising the prospect that these revenues could become an open-ended funding stream subject entirely to presidential discretion.

Let’s remember how this kind of idea was received in the past. President Reagan’s decision to fund the Nicaraguan Contras —even after prohibited by Congress—through secret sales of weapons to the sanctioned Iranian regime resulted in indictments and convictions of several officials. Today, by contrast, the pursuit of discretionary revenue streams has become an overt administration policy. This week, Trump approved Nvidia’s sale of advanced H200 AI chips to China—previously restricted over national security concerns—in exchange for the federal government receiving a 25% cut of revenue. Corporate donations bankroll White House projects. Some tariff revenues will be redirected to farmer bailouts. Oil proceeds may yet be used to settle the president’s $230 million damages claim against his own Justice Department or to reward favored contractors.

With the defense budget poised for a potential 50% increase next year, the opportunities to extract wealth abroad will only intensify. Venezuela may not be an aberration, but a model. If so, it is a model that will allow national policy to serve private enrichment, in a manner and at a scale we have never experienced in contemporary America.

The Dream Ballad

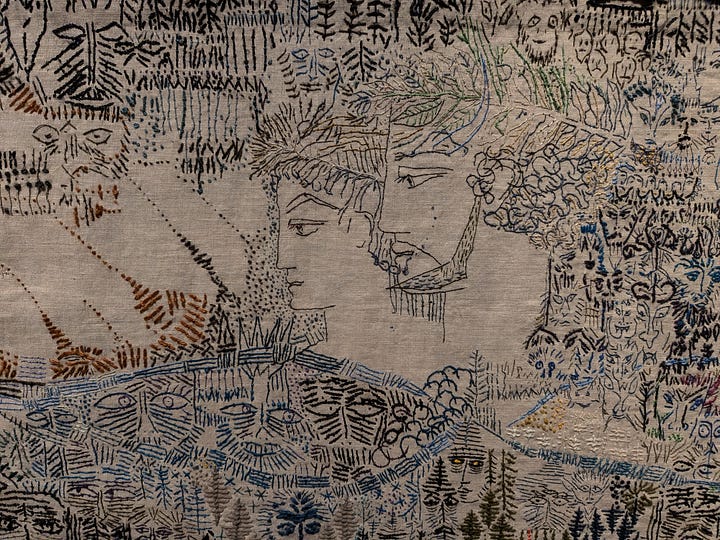

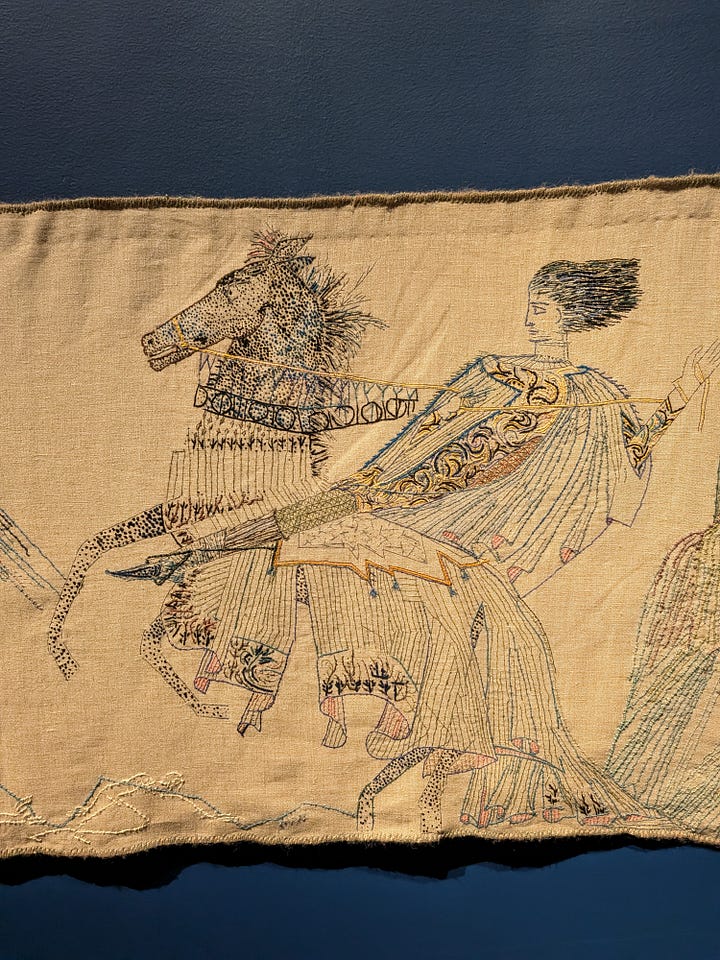

At the age of 9, Torvald Moseid first heard a performance of The Dream Ballad, a poem that was passed down orally in Norway for many generations before it was finally written down in the 1840s.

The poem tells the story of Olav Åsteson, who falls into a deep sleep. When he finally awakens after 13 days, he mounts his horse and rides to the church to recount his visions. Åsteson reveals that he has seen into the realms of heaven and the depths of the abyss, that he has crossed Gjallarbrui – the bridge that separates this world from the hereafter – and witnessed the judgment that falls upon humankind on Judgment Day.

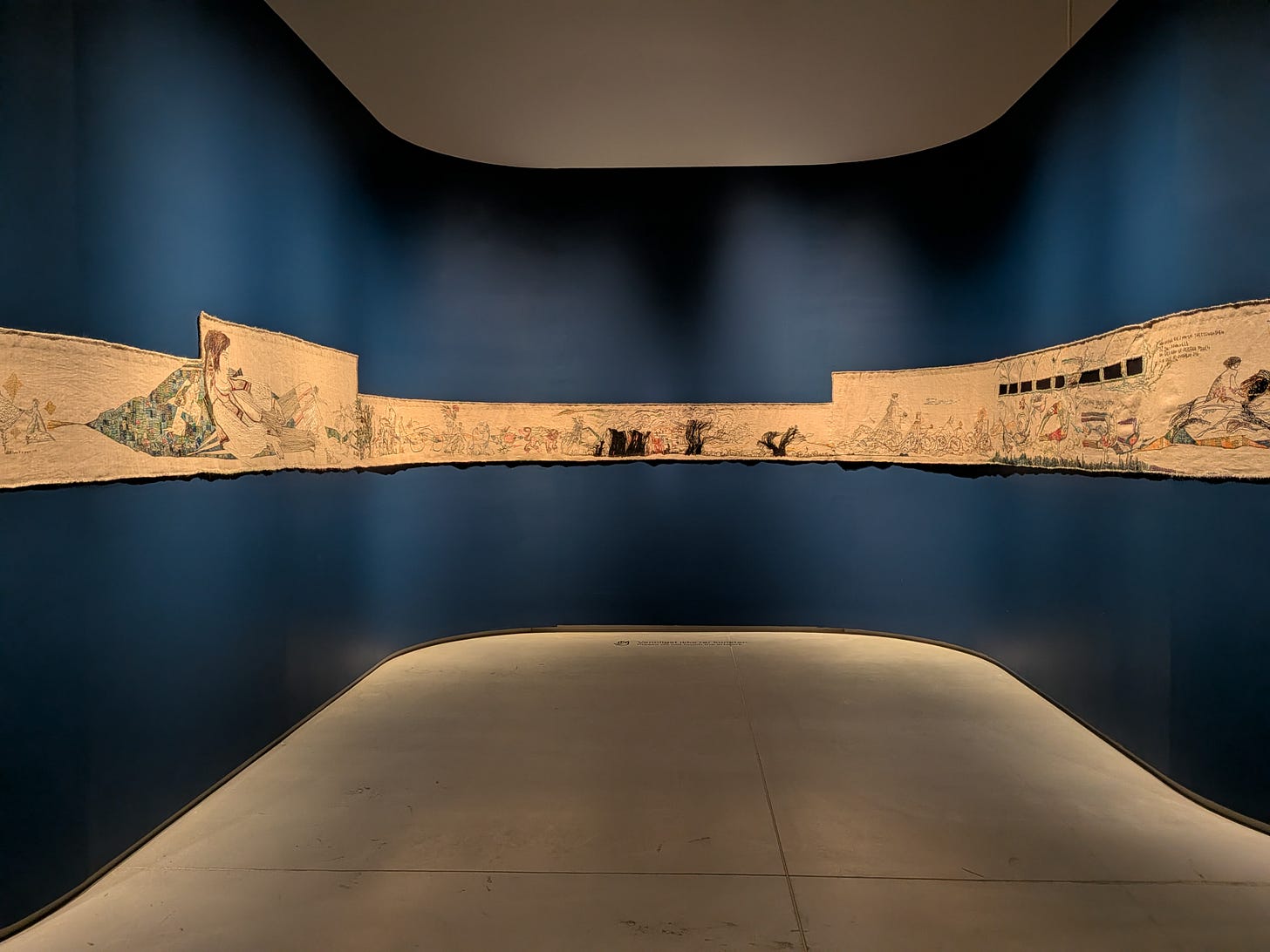

Over fourteen years, Moseid, a Norwegian artist, created a tapestry to illustrate the poem. I saw it last week in a spectacular small museum, Kunstsilo (“the art silo”) in the southern Norwegian town of Kristiansand. I liked a lot of things about the museum, which was created from a renovated grain silo: the tall central hall, the light from outside, the quiet, and the fact that nothing on display, from Finnish modernism to Norwegian abstract expressionism, was familiar. I arrived just as the museum began to play a musical recording of the poem, which it does a few times every day. The tapestry, which is 55 meters long and winds through several rooms, seems both very contemporary and very ancient, like a young descendant of the 11th century Bayeux tapestry.

For the better part of an hour, I was the only person in the exhibit—an unexpected break from the 21st century.

I am writing this just as the conflict over Greenland is accelerating. A reminder that I wrote about Greenland and Denmark a year ago, and nothing fundamental has changed since then. The president is still unable to articulate what, exactly, he needs Greenland for.

Heard you discuss this on the podcast, Anne, and it’s even more chilling reading it all laid out in one place.

The crypto political spending angle is exactly the kind of institutional capture that doesn’t show up in traditional corruption metrics but fundamentally warps democratic accountability.

What struck me: this isn’t even subtle. Single-issue super PACs spending half of all corporate money to install friendly candidates and remove “enemies of the crypto industry” while simultaneously removing the few consumer protections that existed. That’s not lobbying. That’s buying the regulatory apparatus wholesale.

The main story is the human cost of that capture. Life savings gone, no recourse, no investigation. The FBI says “fill out a report” knowing there’s less than 1% chance of recovery. Meanwhile, the industry that enabled the theft is spending hundreds of millions to ensure it stays that way.

This connects to the Venezuela oil kleptocracy—-Same playbook: create unregulated revenue streams, capture the institutions that might provide oversight, use that money to entrench power further. Crypto PACs funding friendly candidates is structurally identical to oil proceeds in Qatari accounts funding presidential discretion.

It’s all building the infrastructure for sustainable kleptocracy. And they’re not even hiding it anymore.

—Johan